Long Term Care Insurance Rate Increases Ohio

To help stabilize long term care insurance premiums and help prevent long term care insurance rate increases, Ohio has enacted strict regulations. Recent evidence shows that these newer regulations are working very well to reduce the frequency and size of long term care insurance rate increases.

To understand why these regulations are working, we must also understand why the older regulations did NOT work.

Profit Incentive

Under the old rules, if a rate increase was requested, the insurance company could price the normal profit levels into the rate increase. In many cases, a rate increase would result in increased profits for the insurance company.

Under the new rules, if an insurance company requests a rate increase, they must first decrease the profit levels in their initial pricing to a cap that is pre-determined by the new regulations. Secondly, they cannot price normal profit levels into the rate increase. Essentially, these new rules have removed the profit incentive in rate increases.

Margin for Error

Under the old rules, the insurance companies were NOT allowed to include in their pricing any “margin for error”. There was no cushion priced into the policy if claims were to exceed projections.

Under the new rules, every insurance company is REQUIRED to include a “cushion” in their pricing to try to avoid the need for any future premium increases.

Actuarial Certification

Under the old rules, the insurance companies did NOT have to certify the accuracy of their pricing assumptions. If their assumptions turned out to be wrong, they would just request a rate increase.

Under the new rules, the insurance companies are required to have a qualified actuary certify that no premium increases are anticipated over the life of the policy. Because of the “margin for error” that is now required to be priced into the policy, the actuary is certifying that the “margin for error” is sufficient enough so that no premium increases are anticipated over the life of the policy.

Caps on Rate Increases

Under the old rules, there was no cap on the rate increases and it was very easy to get a rate increase. Premiums were tied directly to projected claims. If claims projections increased, then premiums could be increased. It was that simple.

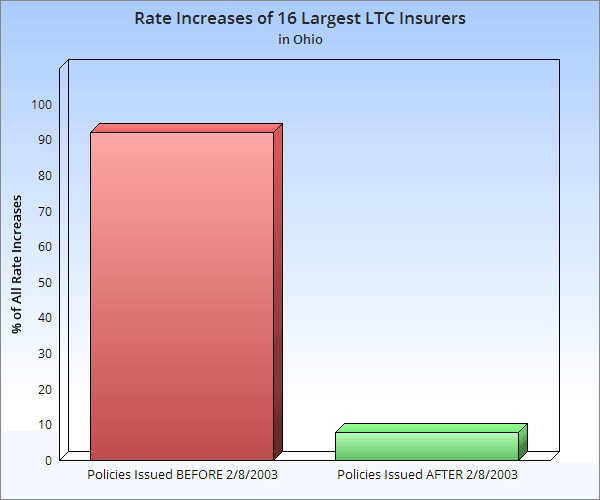

How well are these regulations working in Ohio?

There are 16 insurance companies that have issued over 80% of the long-term care insurance policies. Based upon data published in December 2015, of those 16 companies, 92.18% of their rate increases in Ohio have been on policy forms that are not protected by these regulations. Only 7.82% of the rate increases in Ohio have been on policy forms protected by these regulations. In fact, 8 of the top 16 companies have not had any increases on any of the policy forms they’ve sold in Ohio since February 8th, 2003.

Source: California Department of Insurance, Long Term Care Insurance Rate History 2015 Edition

Not all policies are covered under these new regulations.

Although these regulations are working very well in Ohio, these regulations only apply to policies purchased in Ohio after the regulation became effective. These regulations became effective in Ohio on February 8th, 2003. All policies purchased after February 8th, 2003 ARE protected by these regulations.

Shop and Compare for Long Term Care

Our focus is to help you get the coverage you want, from a top insurance company, for the lowest possible premium.

0 Comments